Fascination About Medicare Advantage Agent

Having wellness insurance has lots of benefits. Even if you are in good wellness, you never ever recognize when you may have a crash or obtain ill.

Average prices for giving birth depend on $8,800, and well over $10,000 for C-section distribution. 1,2 The total expense of a hip substitute can run a whopping $32,000. These instances audio terrifying, yet the bright side is that, with the right strategy, you can shield on your own from most of these and other kinds of medical bills.

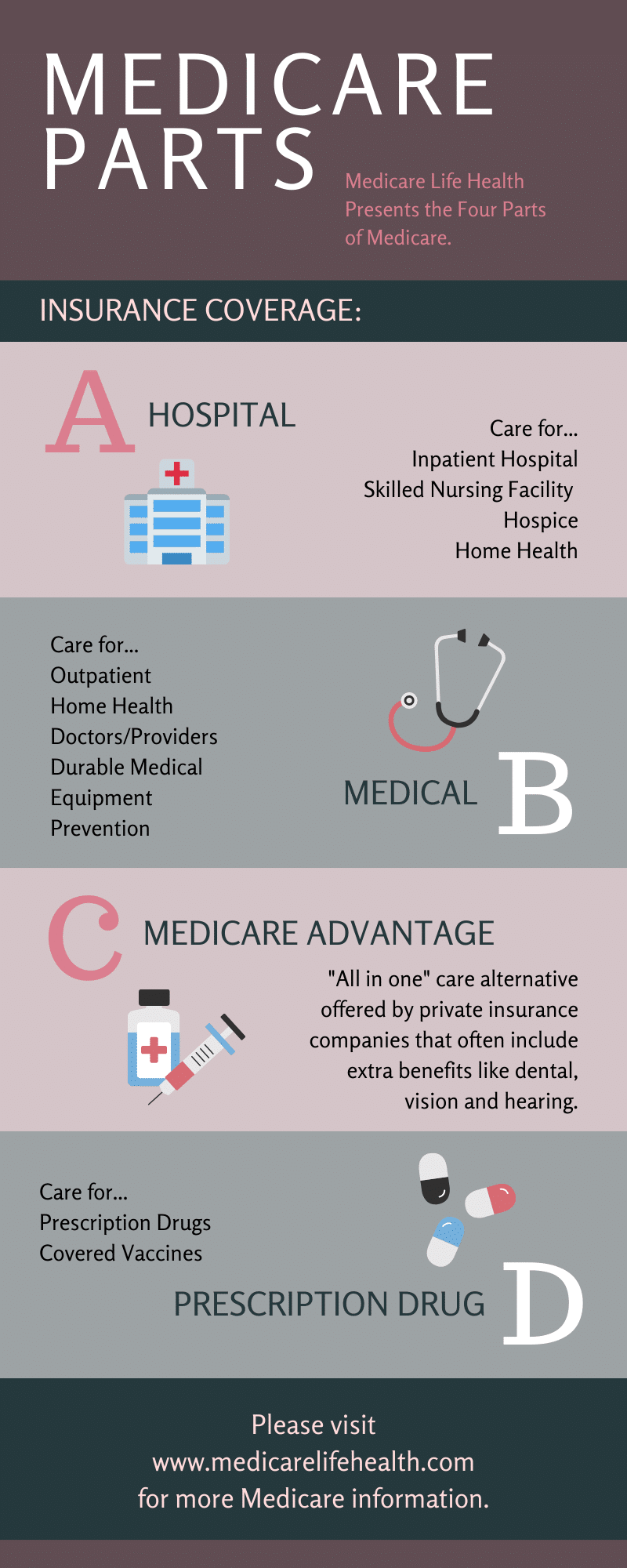

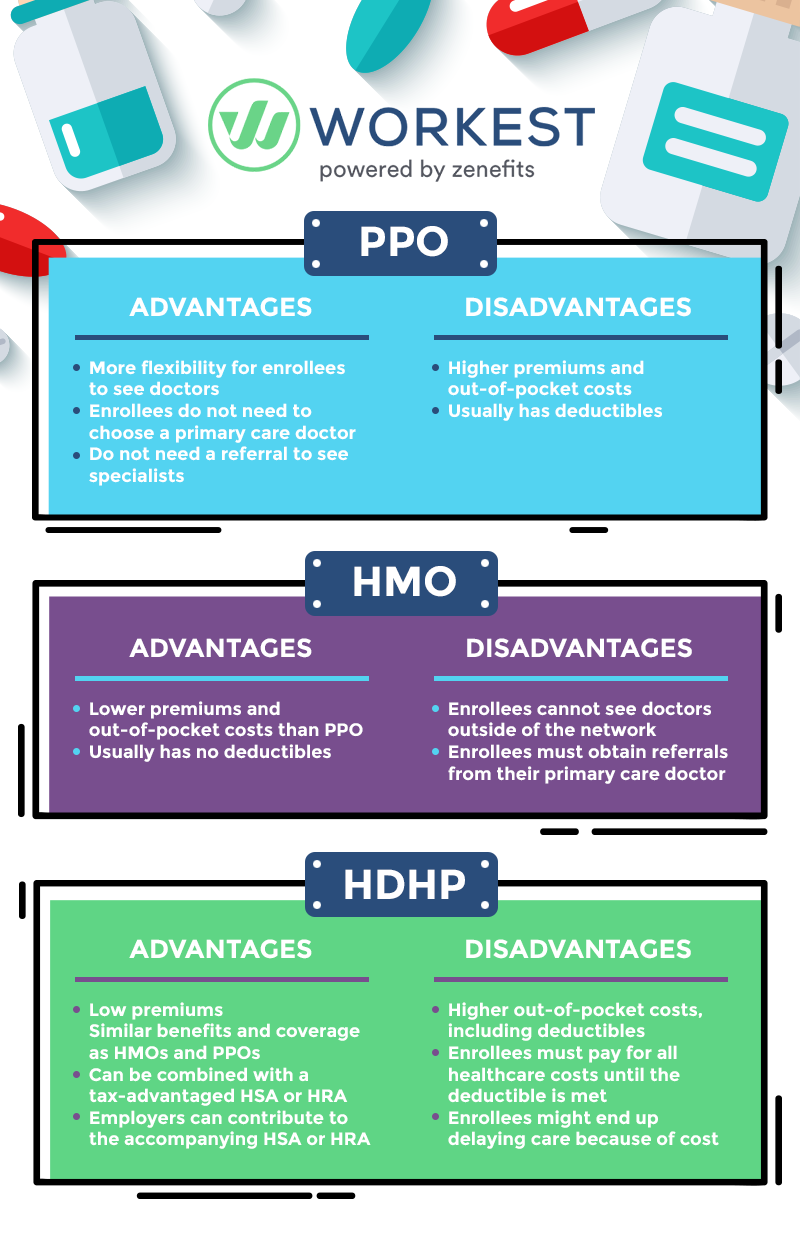

With a good wellness insurance policy strategy, you assist shield the health and wellness and financial future of you and your family for a life time. Medicare Advantage Agent. With the new means to get economical medical insurance, it makes good sense to get covered. Various other key advantages of health and wellness insurance are accessibility to a network of doctors and healthcare facilities, and other sources to assist you remain healthy

All about Medicare Advantage Agent

Today, approximately 90 percent of U.S. citizens have medical insurance with substantial gains in health and wellness insurance coverage occuring over the previous 5 years. Medical insurance promotes accessibility to care and is related to lower death rates, far better wellness end results, and boosted performance. In spite of current gains, even more than 28 million people still do not have coverage, putting their physical, mental, and financial health and wellness in danger.

Particularly, recent research studies that examined changes in states that broadened Medicaid contrasted to those that really did not underscore the value of coverage. Adult Medicaid enrollees are five times more probable to have routine sources of care and 4 times more likely to obtain preventative treatment services than individuals without coverage.

10 Easy Facts About Medicare Advantage Agent Explained

The high rate of without insurance puts stress and anxiety on the broader health and wellness care system. Coverage Issues is the initial in a collection of six records that will be released over the following two years documenting the fact and effects of having actually an estimated 40 million people in the United States without health and wellness insurance coverage. The Board will certainly look at whether, where, and how the health and wellness and economic burdens of having a big uninsured population are felt, taking a broad viewpoint and a multidisciplinary approach to these inquiries.

Medicare Advantage Agent - The Facts

Following the longest financial development in American history, in 1999, an approximated one out of every 6 Americans32 million adults under the age of 65 and greater than 10 million childrenremains uninsured(Mills, 2000 ). This framework will lead the evaluation in prospering reports in the collection and will certainly be customized to address each record's collection of subjects.

The initial check my reference step in recognizing and determining the repercussions of being without wellness insurance policy and of high uninsured prices at the area level is to recognize that the objectives and constituencies served by health insurance are numerous and distinct. Ten percent of the population make up 70 percent of health treatment expenses, a connection that has actually continued to be constant over the past 3 decades(Berk.

and Monheit, 2001). Thus medical insurance continues to serve the function of spreading danger also as it progressively finances routine care. From the viewpoint of health care suppliers, insurance brought by their individuals helps secure a profits stream, and areas take advantage of financially viable and steady wellness treatment practitioners and organizations. Federal government supplies wellness insurance coverage to populaces whom the private market may not offer successfully, such as impaired and elderly individuals, and populaces whose accessibility to wellness treatment is socially valued

, such as children and expectant ladies. The best ends of wellness insurance protection for the private and areas, including work environment areas of staff members and employers, are boosted health and wellness end results and lifestyle. Without doubt, the intricacy of American wellness care financing mechanisms and the wealth of sources of details include in the public's confusion and hesitation regarding wellness insurance policy data and their analysis. This record and thosethat will follow purpose to boil down and offer in readily understandable terms the considerable study that bears upon inquiries of health insurance protection and its relevance. Fifty-seven percent of over at this website Americans polled in 1999 believed that those without medical insurance are"able to obtain the care they need from medical professionals and hospitals" (Blendon et al., 1999, p. 207). In 1993, when national attention was concentrated on the troubles of the without insurance and on pending health and wellnesscare regulation, simply 43 percent of those surveyed held this idea(Blendon et al., 1999 ). They likewise get less precautionary solutions and are less likely to have regular care for chronic conditions such as hypertension and diabetes. Persistent conditions can bring about expensive and disabling problems if they are not well taken care of(Lurie et al., 1984; Lurie et al., 1986; Ayanian et al., 2000 ). One national study asked more than 3,400 adults about 15 extremely major or morbid conditions. Added evidence is offered later on in this phase in the discussion of insurance policy and access to healthcare. People without wellness insurance coverage see page are young and healthy and choose to do without coverage. Nearly half(43 percent )of those checked in 2000 thought that individuals without medical insurance are much more most likely to have health issue than individuals with insurance coverage.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)